GCM Newsletter | April 5, 2021

I’m thinking about nixing the bi-weekly newsletter for Green Country Monitor and sending each post out individually to the email list instead. Haven’t decided yet. It’s a more effective distribution strategy. But it would mean blowing up your inbox more often, which I’m reluctant to do. -G.W. Schulz

OK lawmakers drop plan to cap cannabis-business licenses

A controversial attempt to limit how many cannabis-business licenses could be issued by the state of Oklahoma appears to be over for 2021. Due to a major amendment to House Bill 2272 approved in the Oklahoma Senate on March 30, all attempts to cap business licenses have now been entirely removed.

The bill initially proposed a ceiling of where the number of licenses stood on Sept. 1, 2021. It then sought to slowly reduce the number of overall cannabis business licenses available in the state by not reactivating those that had been surrendered, cancelled, or terminated.

The language capping licenses has instead been replaced by an unrelated rule change. HB 2272 as it’s now written would simply require that cannabis-business licensees disclose to the Oklahoma State Bureau of Narcotics and Dangerous Drugs Control any foreign financial interest within 60 days of application approval.

What OK cannabis bills are still in play?

While the attempt to cap cannabis business licenses by Rep. Josh West (R-Grove) and Sen. Casey Murdock (R-Felt) is over, the 2021 Oklahoma legislative session is not. There are still several other pending bills having to do with cannabis that could significantly impact consumers and the industry.

Current active bills now must be taken up by committees in the opposite chamber from which they originated by the 10th week of the legislative session or they are considered dead. The bills then have two weeks to receive another full-floor vote in the opposite chamber.

These proposals come as the cannabis industry across Oklahoma now has just 26 days as of this writing to become compliant with the state’s program for tracking cannabis plants and products.

Here’s a sample of cannabis bills still on the table:

House Bill 2646 Proposes numerous changes including:

Removes a “good cause” provision requiring state regulators to have specific reasons for denying business-license applications, refusing to renew them, or disciplining licensees.

Allows dispensaries and growers to package and sell their own pre-rolled joints. Prohibits pre-rolls infused with kief or distillate and those weighing over one gram.

Creates a temporary three-day patient permit for non-residents of Oklahoma with no limit on the number of times a person can receive it. The permit would cost $75.

House Bill 2004 Numerous proposed changes including:

Deletes the requirement that 75 percent of surplus proceeds from the state’s 7-percent excise tax on cannabis be used solely for common education.

Allows the Oklahoma Medical Marijuana Authority 90 days, rather than two weeks, to review dispensary, grower, and processor applications.

Makes it easier and cheaper for cannabis businesses to designate employees as official transporters.

Allows a temporary license lasting four months for people who are not residents of Oklahoma.

Senate Bill 445 Just eight words contained in the Oklahoma Medical Marijuana Patient Protection Act are shielding Oklahoma’s roughly 381,000 medical-marijuana patients from harsher punishments that exist elsewhere in state statutes and very much remain active law today.

This bill would remove that shield and make possession and diversion eligible for stiff penalties contained in the Oklahoma Uniform Controlled Dangerous Substances Act, which was passed in the earliest years of the Drug War.

Read on at the link below for a more complete list of bill updates.

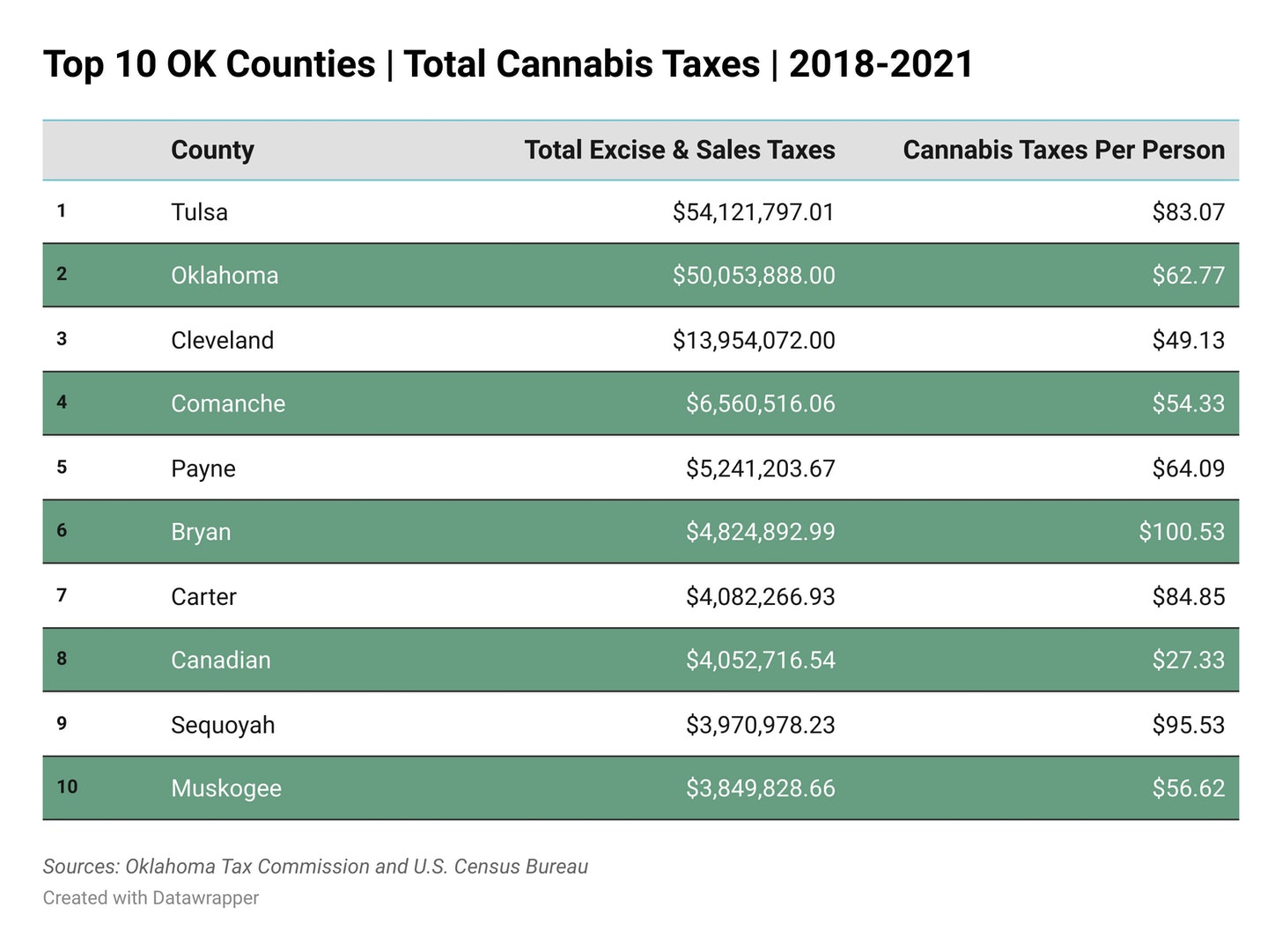

How much are key OK districts generating in new cannabis taxes?

I researched and wrote this post last week when the plan to cap business licenses was still at play at the statehouse. I had asked the Oklahoma Tax Commission for data on cannabis tax revenues statewide since voters authorized the state’s medical marijuana program in 2018. I wanted to look in particular at several state House and Senate districts where elected lawmakers were seeking to constrain the cannabis industry in Oklahoma or boost penalties for violators.

It’s worthwhile to calculate just how much tax revenue this new industry is generating in Oklahoma as we consider whether and how to restrict it. The districts in question have generated over $27.5 million combined in excise and sales taxes. Statewide the total is about $222.4 million. Total Oklahoma cannabis sales have crested $1.3 billion since November of 2018.

That means as much as $0.15 to $0.17 of every dollar spent on cannabis in some areas of Oklahoma are going to taxes.

What I’d initially hoped to get from the tax commission was a list of the top 100 cannabis businesses in the state by sales and excise taxes collected. Among other things, I thought it would give us a clearer picture of how effectively Oklahoma-bred businesses were competing with out-of-staters.

Alas, the state cited business confidentiality rules in blocking that part of my request. But I did get tax remittances by month, city, and county, plus total amounts by excise and state-and-local sales taxes.

For each bill you’ll see a summary of the proposal and what’s prompting the controversy. Next I look at the tax-revenue picture since 2018 of districts represented by the sponsors of these bills. It’s hard to know everything these numbers tell us. But I know the journalism axiom holds true: follow the money.

Let's read OK statutes to find out how SB 445 really does re-criminalize cannabis

When Oklahoma voters authorized medical marijuana in 2018, they did more than simply allow its use with a license. They sent a clear message that the state’s historically severe drug laws prohibiting cannabis were being reformed and that cannabis was being more-or-less decriminalized.

Even without a license, possession of up to one-and-a-half ounces is a mere misdemeanor that cannot exceed a $400 fine. The Oklahoma Medical Marijuana and Patient Protection Act prescribes an even lower fine for “impermissible diversion” by a patient to a person without a license of $200 on the first offense and $500 on the second.

Just eight words contained in the Patient Protection Act are shielding Oklahoma’s some 381,000 medical-marijuana patients from harsher punishments that exist elsewhere in state statutes and remain active law. The Patient Protection Act explicitly states that diversion “shall not be punished under a criminal statute.”

Yet a proposed bill pending in the Oklahoma legislature by Rep. Lonnie Paxton (R-Tuttle) and Rep. David Hardin (R-Stilwell) would remove this protection and make violators susceptible to serious prison time and fines for cannabis possession or diversion to an unlicensed person. Senate Bill 445 has now passed the Oklahoma Senate and cleared second reading in the House.

According to a summary of the bill from the state, this new law would apply to those simply possessing or using cannabis without an Oklahoma license and doesn’t specify “diversion.” SB 445 doesn’t just remove the shield contained in the Patient Protection Act. It asserts that violators would become subject to much more serious penalties prescribed in the Oklahoma Uniform Controlled Dangerous Substances Act.

In its own section of Oklahoma statutes, the Controlled Dangerous Substances Act at times spells cannabis “marihuna” owing to its Drug War origins in the 1970s and 1980s. When reading SB 445 on its face, it does not immediately become clear that the proposal would effectively re-criminalize cannabis in Oklahoma. Understanding how it does this requires looking at the Controlled Dangerous Substances Act.

ICYMI: Drug enforcers loved raiding southeast OK grows 30 years ago

It’s hard to believe the residents of Choctaw County, Oklahoma, in just a few short years have innumerable options within a reasonable distance for purchasing perfectly legal medical cannabis. At one time three decades ago now, Hugo, Oklahoma, the county seat of Choctaw, was a major target in the state’s strident war on weed.

Located along the Texas border in the southeast section of the state, Choctaw County today is home to dozens of cannabis business licenses for cultivators, processors, and dispensaries. But 30 years ago during 1989 and 1990, commando-trained and heavily armed drug enforcers executed eradication campaigns throughout an area where cannabis is freely grown today.

One archived Tulsa World story from a September 1990 grow raid describes a typical scene. There were 65 Oklahoma National Guard soldiers who participated with six helicopters, plus three-dozen armed agents from the Oklahoma Bureau of Narcotics and Dangerous Drugs Control.

As if straight out of a 1990s action-movie thriller, one bureau agent vowed to the media that such cannabis grow raids would continue “until we can’t find any more.”

GCM Roundup | Oklahoma and Beyond

An association representing cannabis dispensaries in Oklahoma announced they were hiring the lobbying firm McSpadden Milner Robinson to help represent the industry’s interests at the statehouse.

More people in Texas are realizing they could be shoveling money at Sooners for the privilege of buying medical marijuana in Oklahoma with a temporary license.

The Baker Institute at Rice University in Texas recently surveyed nearly 3,000 Texans on their cannabis use. Almost two-thirds of those getting cannabis illegally reported spending $100 to $500 each month for it.

Oklahoma now shares two qualities with Humboldt County, California: an enthusiasm for cannabis, and an enthusiasm for Bigfoot lore. Don’t tell the Oklahoma Legislature that we’re becoming more like Humboldt hippies every day.

We’re becoming so much like Humboldt, in fact, they also have rural residents — but from the cannabis industry itself — objecting to new cannabis-cultivation sites.

A former dentist “once well known” in Durant, Oklahoma, got caught selling weed on the black market. Local police believe people were coming from out of state to buy it.

Some genius in Oklahoma City tried to burglarize a dispensary by smashing his car into it. The problem is he smashed his car into the wrong business next door, a shoe-repair shop.

I’ve seen investigative reporters increasingly scrutinizing the cannabis industry over labor conditions. My guess is they’ll increasingly scrutinize the carbon footprint left behind by certain cultivation techniques, too. As this happens, my advice is to not take it personally. Just be ready for it. All industries get scrutinized by reporters. Cannabis is no exception.

Judging by some of the Oklahoma cannabis bills proposed in 2021, this headline should sound familiar: “Rural lawmakers seek power to rein in ‘chaotic’ medical cannabis cultivation.” The headline is out of Canada.

Caps on cannabis-business licenses are off the table in Oklahoma for now. But here’s someone from within the industry arguing in support of caps. He argues that states “can destroy their entire industry” by allowing too much market saturation, and he points to Oregon and Colorado as examples.

I’ve argued before that the cannabis industry should cool its optimism and be mindful of Joe Biden’s historically moderate views on cannabis reform. The White House press secretary confirms that he still does not support legalization and prefers decriminalization.

Green Entrepreneur is asking if self-checkout will be the next big thing in cannabis retail. Not have to deal with bored-looking budtenders? Yes, please.

Here’s a rare instance in which a local government voted to pass tax cuts for the cannabis industry. I just wanted to call attention to it, because tax cuts for cannabis are so rare.

Listening to: Fugazi “Blueprint” Reply with an email or sign up to receive alerts. Follow Green Country Monitor on Twitter, Facebook, LinkedIn, and Instagram. If you appreciate this work, consider leaving a tip.