Districts of OK lawmakers targeting cannabis generated $27.5M in new weed taxes

Among the several cannabis bills pending at the Oklahoma statehouse during the 2021 legislative session, two in particular have raised the ire of critics and reformers. A third caught my attention as a matter of simple fairness to Oklahoma’s still-new legal cannabis industry.

I wanted to find out what the tax picture looked like in state House and Senate districts where elected officials were seeking to curtail the cannabis industry or boost criminal penalties for violations. So I asked the Oklahoma Tax Commission for data on cannabis tax revenues statewide since voters authorized the state’s medical marijuana program in 2018.

They sent me two files that configured the numbers by months. It took some data-journalism finessing, but I was able to get the data into a single sheet for better analysis. That’s what you see in tab one of the first link above. I built the charts below from the results.

For each bill you’ll see a summary of the proposal and what’s prompting the controversy. Next I look at the tax-revenue picture since 2018 of districts represented by the sponsors of these bills. It’s hard to know everything these numbers tell us. But I know the journalism axiom holds true: follow the money.

It’s worthwhile to look at just how much tax revenue this new industry is generating in Oklahoma as we consider whether and how to restrict it. The districts in question have generated over $27.5 million combined in excise and sales taxes. Statewide the total is about $222.4 million. Cannabis sales crested $1.3 billion during the period. That means as much as $0.15 to $0.17 of every dollar spent on cannabis in some areas of Oklahoma are going to taxes.

What I’d initially hoped to get from the tax commission was a list of the top 100 cannabis businesses in the state by sales and excise taxes collected. Among other things, I thought it would give us a clearer picture of how effectively Oklahoma-bred businesses were competing with out-of-staters.

Alas, the state cited business confidentiality rules in blocking that part of my request. But I did get tax remittances by month, city, and county, plus total amounts by excise and state-and-local sales taxes.

A few things to consider about this data. It obviously wouldn’t reflect instances in which cannabis businesses were simply dodging taxes. Also, local city and county governments have considerably different sales-tax rates. For example, Tulsa County has a higher sales tax than Oklahoma County. The city of Tulsa, however, has a lower sales tax than the city of Oklahoma City.

County and city sales taxes are combined here with the state’s 7% excise tax on cannabis and Oklahoma’s 4.5% state sales tax. This data only includes cannabis retailers, i.e. dispensaries, and not other categories of cannabis-business licenses like processors and cultivators. The state also excludes from these figures things like pipes and shirts that are sold as peripherals. Now let’s dive in.

Senate Bill 445

Sponsors Rep. Lonnie Paxton (R-Tuttle), Rep. David Hardin (R-Stilwell)

Status of SB 445 Passed the Senate; cleared second reading in the House.

What SB 445 does Significantly enhances penalties in Oklahoma for possessing, using, or sharing cannabis where all parties do not have state-issued licenses. Violators could face criminal charges under the Oklahoma Uniform Controlled Dangerous Substances Act where they currently do not. That means up to one year of confinement and $1,000 in fines for a first offense. The penalties get steadily worse if you’re already on probation or have prior convictions, or the violation occurred near a school or park or in front of a child. The Oklahoma Health Code contains eight words — “shall not be punished under a criminal statute” — that are shielding legal Oklahoma cannabis from the wrath of the still-active criminal code. SB 445 would remove that shield and effectively re-criminalize cannabis in the state.

Cannabis tax stats of SB 445 sponsors

Senate District 23 (west-central Oklahoma)

Counties

Canadian ($4,052,717 total; $27.33 per person)

Grady ($2,236,212 total; $40.05 per person)

Kingfisher ($219,259 total; $13.91 per person)

Fun facts about Rep. Paxton He won his last race by default with no challengers. Paxton’s family has held property in Oklahoma and farmed here since before statehood.

Canadian County makes the top-10 list for total amounts paid in cannabis excise and sales taxes since 2018 at a little over $4 million. To be fair, there’s a pretty big drop off after Tulsa and Oklahoma counties, each of which top $50 million in total retail cannabis taxes since the state’s medical marijuana program began. None of the counties in District 3 make the top 10 after calculating taxes per capita.

Rep. David Hardin (R-Stilwell)

House District 86 (northeastern Oklahoma)

Counties

Adair ($1,064,713 total; $47.97 per person)

Cherokee ($2,649,993 total; $54.46 per person)

Delaware ($3,599,725 total; $83.70 per person)

Fun facts about Rep. Hardin He also won his last race by default with no challengers. Hardin has not bothered to write any biographical information on his House site since winning office in 2019.

No counties in Hardin’s district make the top 10 for total amounts paid in cannabis excise and sales taxes. However, Delaware County makes the list after calculating taxes per capita at $83.70 for each of the county’s roughly 43,000 residents since 2018.

House Bill 2272

Sponsors Rep. Josh West (R-Grove), Sen. Casey Murdock (R-Felt)

Status of HB 2272 Passed the House; cleared second reading in the Senate.

What HB 2272 does Caps the total number of licenses Oklahoma can issue for cultivators, processors, and dispensaries. Under HB 2272, the ceiling would be set at where the numbers of these licenses stood on Sept. 1, 2021. This bill also calls for the slow reduction of the number of cannabis-business licenses available in the state by not reactivating those that have been terminated, cancelled, or surrendered. This would lead to an eventual number of 2,000 licenses being available for dispensaries, 5,000 for cultivators, and 1,000 for processors, or hundreds fewer business licenses than exist today. West has said his district and others asked for HB 2272 citing black-market activities in their areas of the state. Critics counter the bill unnecessarily hamstrings a legal industry’s potential for success and threatens to violate the Oklahoma Constitution. One amendment in HB 2272 would sunset the law in 2023 to give the state time to review potential unintended consequences.

Cannabis tax stats of HB 2272 sponsors

House District 5 (northeastern Oklahoma)

Counties

Delaware ($3,599,725 total; $83.70 per person)

Mayes ($2,598,216 total; $63.22 per person)

Fun facts about Rep. West He’s a decorated military veteran and served numerous combat deployments in Iraq and Afghanistan. He was shot multiple times during a 2003 battle in Iraq and has earned several medals, including the Purple Heart and Bronze Star.

Like Hardin, no counties in West’s district make the top 10 for total amounts paid in cannabis excise and sales taxes. However, Delaware County, which is also in Hardin’s House District 86, makes the list after calculating taxes per capita at $83.70 for each of the county’s roughly 43,000 residents since 2018.

Senate District 27 (west shoulder of the state including panhandle)

Counties

Beaver ($2,523 total; $.47 per person)

Cimarron (None reported)

Dewey ($48,695 total; $9.96 per person)

Ellis (None reported)

Harper (None reported)

Major ($199,442 total; $26.14 per person)

Texas ($393,536 total; $19.69 per person)

Woods ($218,444 total; $24.84 per person)

Woodward ($1,059,842 total; $52.44 per person)

Fun facts about Sen. Murdock I was born and raised in Tulsa. Not until researching this post did I know Oklahoma had a Panhandle State University. Turns out we do. Among its two notable alumni listed on Wikipedia is Jim Holder who set the college football rushing record for the National Association of Intercollegiate Athletics in 1963. But Wikipedia says a citation is needed. Panhandle State was conceived in 1909 as an agriculture school similar to Texas A&M. Murdock lists his occupation as “farmer/rancher” and sponsored a resolution proclaiming March 23, 2021, Oklahoma Agriculture Day.

There are four counties in the tax data the state gave me that reported no retail cannabis sales or excise taxes at all. Three are in Murdock’s district. The fourth is Roger Mills County. No counties in District 27 appear in the top-10 lists. So perhaps Murdock can argue cannabis just hasn’t done his district a lot of favors since it arrived to Oklahoma.

Murdock may even be hearing complaints from constituents about newly arriving licensees that are simply overshadowing the district-wide $1.9 million in cannabis taxes. All of the panhandle’s Beaver County and its 5,300 residents reported total taxes since 2018 that are basically the fee for a single cannabis-business license. Impressive given what other counties are reporting.

House Bill 2930

I haven’t seen this bill attract a lot of attention from Oklahoma cannabis reformers online. But in my view, it deserves scrutiny. Rep. Rick West (R-Heavener) and Sen. Frank Simpson (R-Springer) are sponsoring House Bill 2930, which contains a little-noticed provision. It would ban the state from awarding loans and grants to cannabis-related proposals from a special Oklahoma initiative designed to promote interest in agriculture called the Agricultural Enhancement and Diversification Program.

HB 2930 passed the House 91-0 and is making its way through the state Senate. The problem is I can’t find anything in the bill or in state statutes creating the program in 1999 that give a good reason for why legal Oklahoma cannabis cultivators shouldn’t be allowed to participate in the program. Cannabis cultivation legitimately diversifies and enhances Oklahoma agriculture.

The only reasonable justification I could think of for the exclusion was that federal dollars were commingled with the program and thus required that state-legal cannabis be left out. That would make sense. But as far as I can tell, it’s exclusively a state program. The HB 2930 provision seems only to be a sneer at the modernism Oklahoma cannabis represents from a traditionalist perception of American agriculture. Tell that to Farm Aid co-founder and cannabis entrepreneur Willie Nelson.

So let’s take a look at the cannabis tax stats of Representatives West and Simpson.

Cannabis tax stats of HB 2930 sponsors

House District 3 (southeastern Oklahoma)

Counties

LeFlore ($2,954,338 total; $59.26 per person)

Fun facts about Rep. West The internet can’t decide if it’s spelled “LeFlore” or “Le Flore,” but the proper spelling is probably LeFlore. West found himself in “plenty of political crosshairs,” as Tres Savage from Nondoc describes it, when in 2018, he voted against a pay raise for teachers during a fierce debate over the subject. West then decided not to seek re-election but returned two years later to retake House District 3 during the 2020 election.

The single county of LeFlore contained within West’s House District 3 has generated more in cannabis taxes since 2018 than all of the nine counties in Murdock’s Senate District 27. West’s May 2020 candidacy announcement made this promise: “I will represent my district and no place else.”

Sen. Frank Simpson (R-Springer)

Senate District 14

Counties

Carter ($4,082,267 total; $84.85 per person)

Johnston ($340,636 total; $30.73 per person)

Love ($1,117,866 total; $109.03 per person)

Murray ($690,361 total; $49.06 per person)

Fun facts about Rep. Simpson He’s probably been teased about being a Navy veteran in landlocked Oklahoma. Despite the message the above provision seems to send, Simpson separately opposed efforts this year made by other Republicans at the statehouse to roll back criminal justice reforms passed by voters in 2016. These reforms reclassified low-level drug crimes from felonies to far-less serious misdemeanors.

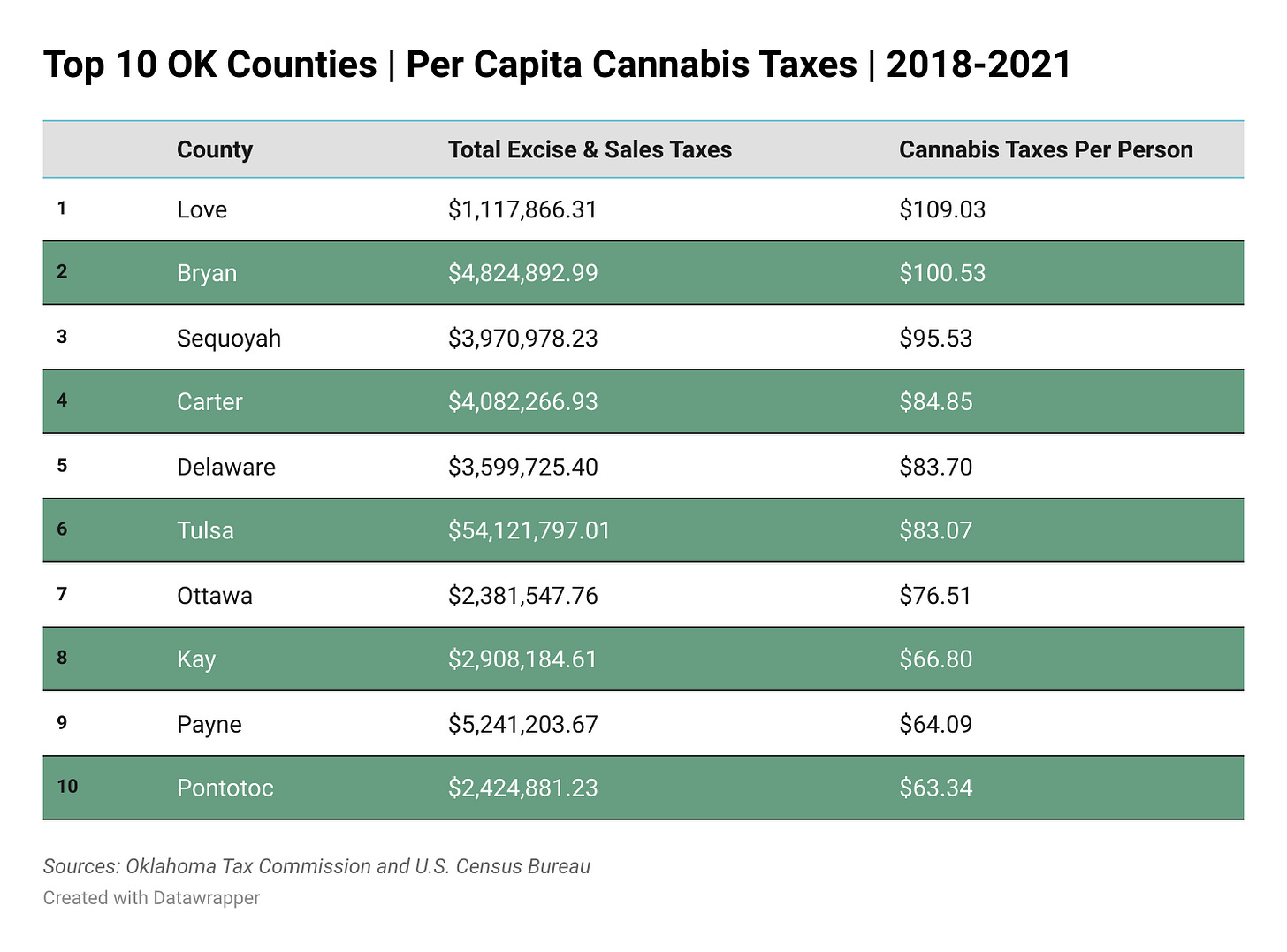

Simpson’s humble Senate District 14 appears to enjoy cannabis quite a bit. According to my calculations, Love County and its 10,200 residents on the state line with Texas have generated more in cannabis taxes per person since 2018 than any other county in the state at over $100 each. But the $1.1 million that Love County reported overall makes it 32nd in total taxes reported. Carter County, on the other hand, just north of Love County, makes both top-10 lists with about $4 million in total taxes reported at $84.85 per person.

Ironically, Simpson’s district stands to uniquely benefit further if another bill having to do with cannabis passes this session. House Bill 2022, sponsored by Rep. Scott Fetgatter (R-Okmulgee) and Sen. James Leewright (R-Bristow), would allow new temporary patient licenses for nonresidents of Oklahoma who do not already have a medical marijuana license in their home state. The temporary license would be valid for two years and cost $200.

Industry observers and journalists are beginning to notice that HB 2022 could become a powerful surge for the Oklahoma cannabis industry and state and local tax coffers. The market-analysis firm New Frontier Data pointed out last year in a special look at Oklahoma cannabis that cannatourism from the Dallas and Fort Worth areas alone could translate into a windfall for the Sooner State with Love and Carter counties poised to rake in Longhorn dollars.

Listening to: Willie Nelson “Hello Walls” Reply with an email or sign up to receive alerts. Follow Green Country Monitor on Twitter, Facebook, LinkedIn, and Instagram. If you appreciate this work, consider leaving a tip.